…You’re both set in your financial ways

Allowing someone into your life can mean

surrendering a degree of control. “Financial and emotional independence often

coincide, especially when you’ve been single for a prolonged period,” says

Lurie.

Capetonians Caryn, 27, a journalist, and

Rob, 29, an IT consultant, had both been single for a few years before getting

together and, naturally, they had their own ideas about spending and saving.

While Caryn saves and avoids splashing out, Rob earns well but doesn’t set

anything aside. “Rob isn’t a frivolous spender, but he enjoys the finer things

in life and can rarely say no to a bargain,” says Caryn, who bought her car

with cash and put a large deposit down on her flat to lower the bond

repayments. “I work hard at making my money work for me,” she says. However,

Rob’s biggest expense is paying off his car – a constantly depreciating

commodity.

When starting a new relationship, “talk to

your partner about how you’ve handled certain affairs, where it has worked for

you and where you might require his assistance,” says Lurie.

Having both a joint and personal account

works for many couples. But remember that once your partnership becomes

permanent you are answerable and accountable to each other. Bills often have to

take precedence over a new pair of shoes or a handbag (tough, we know!).

Caryn has re-evaluated her spending since

the couple moved in together. “I’ve learnt that living frugally can sometimes

mean not living”. She understands that when marriage is on the cards and assets

and expenses are combined, they’ll have to compromise further. “But I’m still

not certain I’ll enjoy putting money into a pot that will be used to pay off

Rob’s car!” says Caryn. Likewise, Rob is contributing to Caryn’s flat, which

may not have been his first choice of home.

Nevertheless, Caryn and Rob’s compromises

have enhanced their relationship – because they’ve both had to make them.

“Compromising is not sacrificing your individual needs, but making choices that

will benefit the relationship, and that will ultimately benefit both parties,”

says Mallaby. And with that out of the way, you can leave space for enjoying

life, and each other – and that doesn’t cost a thing.

How to talk money with your honey

Our Guy Next Door reveals the best ways to

have the chat

How you tackle money together is important.

For a guy, even if he’s not a high-flying businessman, lawyer or banker, the

need to be capable of providing is huge. Take that away and he’s left

emasculated, listless, and a shell of what his earning capacity could be.

Don’t be the money police

By nature, men and women have different

approaches to cash. Probably an evolutionary hand-me-down from the “you tend

cave, me attack 10-ton woolly mammoth with whittled stick” school of investing,

men tend to take more high-reward, high-risk options, while women are better

savers. For guys, it’s often a question of self-esteem – a dick-measuring contest.

Run through some “what-if” scenarios if you

won the Lotto – it will give you a better understanding of how the other views

money and help you chart a way forward that keeps you both happy.

And remember, while it’s cool for your

focus to be on holidays together and recovering that hideous paisley lounge

suite, merely thinking about the money you’ll need to pay for it is not going

to help. Whether you’re at the joint account stage or not, implement a few

simple rules based on what you’re earning. For example, after bills, a

percentage of your salaries goes to paying each of you an allowance to spend as

you like, while another percentage goes towards chipping away at the cost of

bigger purchases/ dreams/ trips and so on. And those purchasing decisions are made

by committee of two. No maverick ideas to raid the fun fund and buy first-class

tickets to Rio (unless your surname is Motsepe, of course)

What not to say to your guy

Why don’t I run the finances?

Unless he really has zero aptitude for

dealing with money, attempting to completely sideline him is exclusionary and

condescending and reeks of Anna Nicole Smith. Have roles, but do it together.

What have you been doing with your money?

Chances are he’s been pumping a lot of it

into your relationship. Accusing him of wasteful expenditure may open up a can

of worms regarding how both of you spend of don’t spend cash. It could also

give rise to score-keeping and stamp out any desire he may have to splash out

on you just because he feels like it.

What’s this statement reference for Sloppy

Joe’s Titty Bar?

If you have separate accounts, don’t go

snooping. If and when you decide to share your financial information, you still

need to show some discretion. Unless, of course, you think he’s wasting your

future children’s university fund on the former Ukrainian beauty queen.

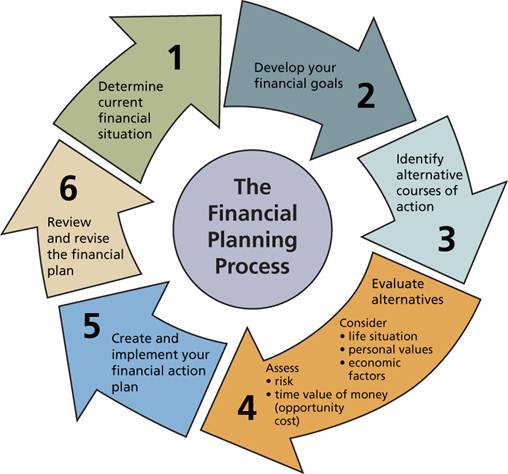

Functional Financing

Financial

Planning Process

Get your finances – and relationship – in

order with these tips from certified financial planner Natasja Norval Hart.

1. Each partner should consider their spending habits – especially when

it comes to luxury items. Do you shop to fulfil a need, keep up appearances or

to compensate for another area in your life? By understanding this, you can

both nip potentially problematic purchasing behavior in the bud.

2. A budget is more than just a list of planned expenses; it’s also

about reviewing what you actually spend. Set aside time at the end of each

month to review your finances together – and make it fun by giving yourselves a

reward on completion. And choose a time that suits both of you. Just before

kick-off is not a good idea.

3. Discuss big expenditures with your man. Is upgrading to the iPhone

4S really necessary? Will watching television in 3D revolutionise your world?

The price of items such as TVs and other electronics tends to drop quickly, so

holding off on knee-jerk, emotional spending could work in your favour.