We put 53 popular credit cards to the test

On the surface, the HSBS Platinum

MasterCard with Cash or Fly Rewards and the Capital One Venture card seem

comparable. If you like to travel, you might find their pitches enticing: Both

let you earn points that you can use for plane tickets. But a cardholder

charging $1,500 a month would get $460 worth of points in the first year with

the capital One card and only $180 with HSBC’s card.

Paying

down balances on his high-rate cards is a challenge for Robert Muthumbi of

Flowery Branch, Ga., shown with his wife, Rene, and their sons, Gordon and

Gerard.

Whether you’d uncover that difference is

debatable. Sure, you’re a savvy consumer. But these days, picking the right

rewards card- the most heavily marketed type-seems to require an advanced

degree in mathematics. Many have complex formulas for determining how much cash

or how many points you’ll earn. Some cards come in two versions: one with no

annual fee and another with a fee but higher rewards.

If you carry a credit-card balance, you’ll

have to do calculations to determine whether you’ll save by transferring it.

Some cards offer a 0 percent annual rate on balance transfers, but only for a

limited time and for an up-front fee

To help you make sense of the wide range of

credit-card deals, the Consumer Reports Money Lab developed a computer model

for evaluating cards. It takes into account the total costs of carrying and

transferring a balance and estimates the rewards you stand to earn based on

your spending patterns. We tracked down the terms of 53 mass-market credit

cards and used the calculator to determine the best ones for three types of

users: families looking for cash rewards, leisure travelers who want free trips

and cardholders who carry a balance. We also gave credit-card make-overs to

four readers for whom we found better cards than what’s in their wallets.

Here’s what else we found:

·

Rewards cards offer tempting sign-up deals to

consumers with good credit scores. If you haven’t compared your cards with

what’s available now, you should.

·

Annual fees might be worth paying for frequent

travelers and big spenders.

·

Mass-market airline cards are offering

perks-travel insurance and free checked baggage, for example-that used to come

only with high-fee premium cards.

·

Although 0 percent transfer cards seem enticing,

especially if you have a big balance to payoff, a low-rate card might be the

better deal in the long run.

New travel-card perks

Up-front bonuses of 25,000 to 40,000 points

have become common among travel cards, and occasionally you’ll see a juicy

100,000-point offer. Travel cards often charge annual fees, though many are

waived for the first year. But the perks that come with many airline

cards-expedited security clearance, priority boarding, free checked luggage,

and access to airport lounges- can more than make up for the fee. “It’s silly

not to get an airline card with free checked baggage, because it pays for

itself after a single trip,” says George Hobica, publisher of the

Airfarewatchdog website, which tracks airline deals.

George

Hobica, publisher of the Airfarewatchdog website : “It’s silly not to get an

airline card with free checked baggage, because it pays for itself after a

single trip”

But don’t’ assume that cards offering a

25,000-point sign-up bonus will get you anything more than a one-way ticket.

You might need to spend up to 50,000 points for a domestic unrestricted

round-trip ticket. “Before you even think about an airline card or other points

cards, consider what you’d get from a cash-rebate card-it’s cash in hand with

no restrictions”, says Tim Winship, editor of FrequentFlier.com. If you want an

airline-specific card because that carrier is the one you fly most frequently,

you might want to wait for a big sign-up offer before you apply.

International travelers can choose from

about three dozen travel cards that don’t charge foreign-transaction fees

(typically 3 percent with cards that do, which would cost you $90 on a $3,000

overseas vacation). And some U.S, insures, notably Wells Fargo and Bank of

America, now offer chip-an-PIN cards, also called EMV smart cards (the acronym

comes from Europay MasterCard Visa). Those cards, prevalent in Western Europe,

are more secure than the magnetic-stripe type issued in the U.S. If you travel

to Europe, it might be worth getting one because standard cards are often not

accepted at subways, parking facilities, and gas stations.

Maximizing rewards

If you have a basic cash-back card, rewards

should be straightforward. But some cards have formulas that are anything but.

Chase Freedom, Citi Divedend, and several Discover cards tout rewards of up to

5 percent, but only on quarterly rotating categories, such as home-improvement

purchases in the spring and hotels in the fall. You have to opt on each quarter

to qualify for those rewards. And you have to plan your spending around each

category, which can be difficult because sometimes the categories might not be

announced well in advance. Spending in some categories, such as gas, might earn

the maximum rewards only up to a certain amount, after which the percentage

rewards are lower. For instance, from July through September, the Discover More

card paid 5 percent on gas, theme parks, and movies, up to $1,500 in total

purchases. After that, you’d have earned only 0.25 percent, unless you’d spent

$3,000 in non-bonus categories for the year.

Using

credit cards rather than debit cards and cash for more of their everyday

spending will boost the rewards Shane Tripcony of Little Rock, Ark., and his

wife, Erin, can earn each year.

That kind of complexity can make it difficult

for cardholders to maximize their rewards. Shane Tripcony, 42, of Little rock,

Ark., a father of two and entrepreneur who runs a Web marketing and development

company, has two credit cards but is not earning the kind of rewards he could

be. He and his wide, Erin, tend to use cash or a debit card for gas and

groceries rather than credit, even though they pay off their balances in full

and on time each month. He wants to boost his cash-back rewards by charging his

children’s private-school tuition-almost $15,000 a year.

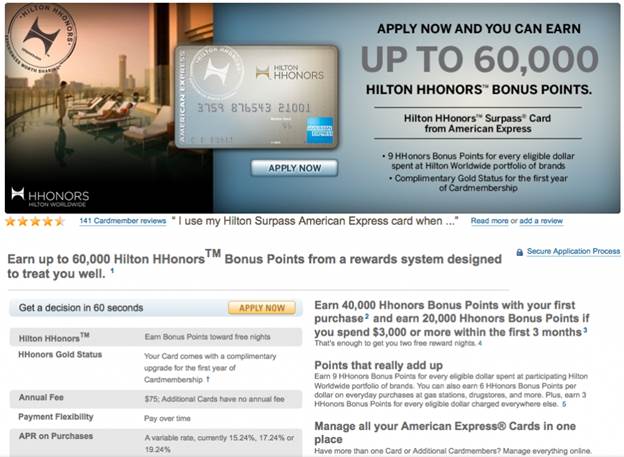

Though he doesn’t travel often, he’s

considering signing up for the American Express Hilton HHonors card to use for

an upcoming family vacation. Tripcony figures the trip’s cost would be largely

covered by the card’s up-front bonuses of 40,000 points after the first $750 in

purchases. But how far the bonus points go will depend on the type of hotel and

room he books. Hilton ranks its hotels in seven categories. A standard room in

the lowest is available for 7,500 points a night, and the highest category

costs 50,000 points a night. The Hilton HHonors rewards website has a search

function with results that include the pints or dollars needed for a night‘s stay

at all of its properties.

The American Express Hilton HHonors card

Beyond this vacation, Tripcony could earn

many cash rewards if he and his wife used a credit card rather than cash or

debit for everyday purchases as well as for tuition. A good card for them might

be the American Express Blue Cash Preferred cards, which pays rewards of 6

percent on spending in supermarkets, 3 percent at gas stations and department

stores, and 1 percent on everything else. Based on their spending habits,

charging $3,000 monthly on it would result in a cash reward of about $1,040 in

the first year because of an up-front bonus and $890 in subsequent years, even

after paying the $75 annual fee.