Finally, there is

financial preparedness. This goes beyond having your child develop a

budget for living expenses while away at school. Financial preparedness

means both you and your child are on the same page about the financial

implications of college choice. It means that you both clearly

understand how your family will be paying for college.

Financial

preparedness means getting clear in your own mind where you stand on the

issue of paying for college. Is it your expectation that you will pay

for any college, regardless of the cost? Does your child have the same

expectation? Can your child go anywhere she wants, as long as she can

get admitted? This is the “college first” approach, in which a student

selects the college and the parents figure out how to pay for it. Is

this the way you see it? If this is the way your child sees it, are you

two in agreement?

If you are not going to

be able to pay for college, or if you will not be able to pay the full

amount, do you expect your child to borrow money for college? If so, how

much debt are you comfortable with your child taking on to pay for

college? Is the message you are communicating to your child that no

amount of money is too great to borrow to go to certain schools? Is this

the message your child is getting from family, friends, counselors,

teachers, and college recruiters? If so, does your child understand the

long-term implications of the debt she will be taking on?

Because college

recruiters often communicate with students in the high school before

parents are involved, and because recruiters often frame the decision

about where to go to college as a “college first” decision, it is

important to examine your beliefs around college choice and communicate

them clearly to your child before you both get swept up in the emotion

of the college admissions process.

You and your

child will experience heavy marketing around choosing a college. As the

pool of traditional-age students grows smaller in the next few years,

there will be more and more recruiting pressure on your child to

consider different schools. You need to be clear about where you stand.

Talk with your child about how the decision about college will be made

in your family. Will the decision be your child’s alone? Will it be your

decision? Will it be a joint decision, based on the overall financial

situation of the family as well as your child’s best interest, both

academically and financially? This is the “cost first” approach. How

much can you afford to pay for college? Given what you can afford, which

colleges are the best fit for your child?

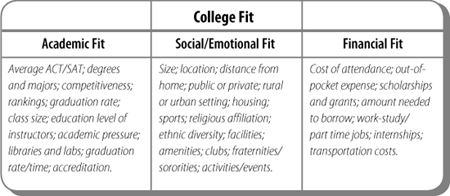

The College Fit

worksheet will help you organize your thoughts around college fit. Think

about your child’s academic, social, and financial preparedness for

college. Then identify the corresponding information about the colleges

your child is considering. This will give you more data upon which you

and your child can base the college decision.

A student who is

strong both academically and socially and who has unlimited financial

resources might be encouraged to go anywhere. A student who is strong

academically but socially and emotionally tentative might be encouraged

to look at schools closer to home. A college that is a two- to

three-hour drive home for the student to recharge and refocus might be a

better fit than a college with a six-hour plane flight between school

and home. An academically strong student with good social skills but

limited financial resources might look for schools providing the best

scholarship offers, keeping in mind the need to limit student loans to

cover transportation costs and living expenses. A student with good

social skills but weak academic skills who has unlimited financial

resources might look for a private college that offers a strong academic

support program to help her build her skills to the college level and

go on to finish a college degree. An academically weak student who is

also socially weak, even with unlimited resources, might be wise to

attend college close to home until she has demonstrated she is capable

of college-level work.

There is no “one size

fits all” way to choose a college and no one “right” college for every

student. The transition to college is a major developmental milestone,

and not all students are at the same developmental stage when they

graduate from high school. College choice should be made accordingly.

Whatever

decision you and your child make, you will have to come up with the

money to pay for it. Is there a way to identify the true cost of college

before a child enrolls?