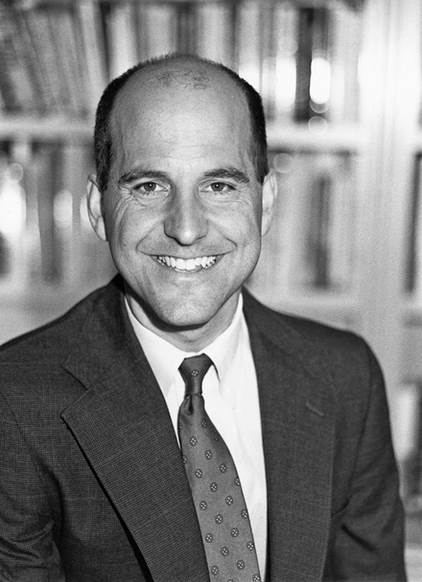

Nationally syndicated personal – finance

columnist

The worst decision I made was being too

conservative when I first starting investing in my company’s 401(K) in my 20s.

I took advice from a co-worker who was about 10 years from retirement and very

conservative. He made me scared of the stock market, so I put most of my money

in bonds. And I didn’t change that selection for years, so I missed out on some

roaring times in the stock market.

Eric Tyson

Author of “Personal Finance for Dummies”

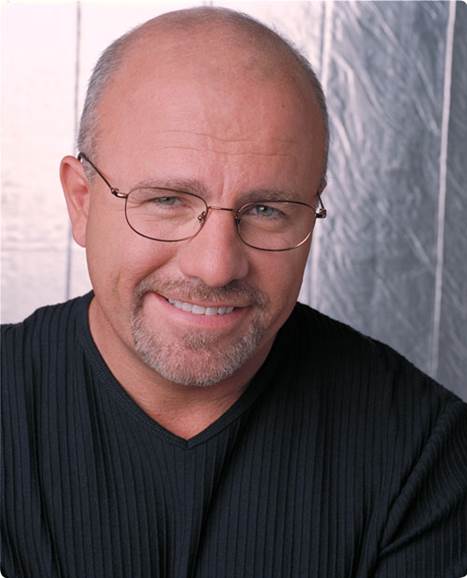

My biggest mistake was investing a few

thousand dollars through a precious – metals company, IGBE. It ran ads in

prominent publications, which gave it credibility, and smooth-talking people

handled the phone lines. IGBE turned out to be a fraudulent business and ended

up bankrupt. I learned a valuable lesson – to do lots of homework before

investing through any company.

Dave Ramsey

Radio personal finance expert and

author

By the time I was 26 years old, my wife and

I held real estate worth over $4 million. I was good at real estate, but I was

better at borrowing money. I had built a house of cards. We went through

financial hell, and lost everything over a three-year period. We were sued,

foreclosed on, and finally were bankrupts. After that we said, we’d never have

debt again- and we haven’t.

Doing it right: Readers give lessons in building wealth

Our recent retirement survey included

several dozen subscribers who reported a net worth of well above $1 million.

When we interviewed a handful, we found a common theme: frugal living. Here’s

how three built their fortunes:

Early savings

Kenneth Maltz of Jericho, N.Y., taught

instrumental music in public schools for 34 years and retired at 55 with a net

worth upward of $1 million. He credits that nest egg to a good pension,

diligent saving, and nerves of steel when investing.

“The most important thing was starting to

set the money aside at an early age and not skipping a paycheck’s

contribution-ever,” says Malsz, 64. “The second was realizing that not spending

on a fleeting pleasure would pay off years later.”

Kenneth

Maltz of Jericho, N.Y says he started investing in his early 30s

Maltz says he started investing in his

early 30s. He always salted away the maximum allowable contribution into a

tax-deferred 403(b) retirement plan. Knowing he would have a teacher’s pension

made it easier to take some risks investing in individual stocks. “What I was

good at doing was not panicking when the market took a downturn,” he says. “I

always believed that when times are bad and shares are low, that’s the time to

buy.”

Maltz spend retirement playing clarinet in

bands specializing in klezmer, a kind of jewish folk music. Musician friends

who eschewed day jobs now express envy at his financial freedom. “I had to turn

down a lot of music work when I was younger because I was teachning,” he says.

“Now I’m in a good position.”

Savvy investing

Mary Haskin of Seattle made a lucky bet on

her future when she joined Genentech, then a growing biotech company. But kept

the money she made there – and made it grow- through old-fashioned smarts.

“I was the type of person to live below my

means and to plan,” says Haskin, 57. That meant always paying at least one

extra mortgage payment a year and carrying no credit-card debt. “I made

substantial money, but I didn’t need to spend it all,” she adds.

Haskin left a three-year stint as a

high-school English teacher to become a pharmaceutical saleswoman. She joined

Genentech in 1997. As she climbed the corporate ladder, she gained stock

options. Unlike others who cashed in their options, she held on and

diversified. Three years ago, she retired with a net worth in the mid-seven

figures. She now spends time with her partner doing numerous sports, volunteer

activities, and hobbies.

Currently, more than half of Haskin’s money

is in fixed-income funds and 16 percent is in stock mutual funds, with 5 to 10

percent more in individual stocks. She invests a small percentage of her wealth

in nonfinancial investments, including individual farms in the Midwest. She

credits her continued success in part to close communication with her financial

planner.

Real-estate niche

Bob Berkowitz of Crescent city, Calif., has

found a way to spin gold from vinyl siding. The 72-year-old rents out several

manufactured homes in his rural town and surrounding areas. He has fixed up and

sold many more.

“Investing in rental properties is way

different in rural areas vs. metropolitan areas or big cities,” he says. “You

have to make sure all parties are winners, because you are going to run into

your renters everywhere.”

Bob

Berkowitz of Crescent city says: “Investing in rental properties is way

different in rural areas vs. metropolitan areas or big cities,”

Berkowitz says manufactured homes built

after 1985 are sturdy and easy to rehab. He won’t touch a property that can’t

generate cash flow from the first days he rents it. He also fixes up and

resells distressed and foreclosed houses.

Eighty-five percent of Berkowitz’s net

worth and income derives from real estate, he estimates. Social Security and an

investment in a research company make up the rest of his income. “I gave up on

stocks, bonds, mutual funds, and other investments that are managed by others a

long time ago,” he says. “I found out that the best manager of my money is me.”