Folks in retirement or

nearing that milestone have bit news to cheer. A recent retirement survey of

online subscribers by the Consumer Reports National Research Center found that

the average retirement-account balance rose by 6 percentage points in the past

year, the largest gain we’ve measured since the financial crisis hit in 2008.

Hobbies help you maintain your identity

post-career

But if you’re feeling

buoyed enough to start your countdown to retirement, take note: Our survey also

identified three factors- not all monetary-that can undermine retirement satisfaction.

Here’s how to address them:

Set money boundaries

Create realistic

financial limits with your adult children, especially those more likely to seek

your help. Retirees in our survey who reported family concerns had less

positive experiences after retiring than those who didn’t. And leading the list

of such concerns was financial support for adult children (17 percent) and

elderly parents (3 percent). Our readers were generous, providing a median of

$8,990 annually to family members.

J. Gallo, an estate

attorney in Los Angeles, and his wife, E. Gallo, a psychotherapist, have

written two books on family financial literacy. They say that for adult

children, four types of expenses are worth paying for, at least in the short

run, because they can foster independence: tuition, vocational testing, health

insurance, and specialized services, such as psychiatry and treatment for

substance abuse.

You should communicate your expectations

up front and set monetary and time boundaries in writing

With any subsidy, the

Gallos say, you should communicate your expectations up front and set monetary

and time boundaries in writing. For example, if your son wants to live at home

to save money, he should tell you how he plans to earn money, what he’s saving

for, and when he’ll be leaving.

In the interim, you

can charge rent, assign chores, and even require that he pay interest if you

decide to give him a loan. If the money you provide is a gift, limit the amount

but don’t attach strings.

Get your house in order.

Address your housing

situation well before retirement. Our survey found that only 43 percent of

respondents who felt stuck in their homes were highly satisfied with their

retirement, compared with 71 percent who didn’t fell stuck. Seven percent of

respondents said they wanted to sell or downsize but couldn’t.

A home that’s selling

for just a bit less than comparable in your area will sell more quickly,

real-estate experts say. Pricing it at a round number – say, $250,000 rather

than $249,000 will get the attention of buyers searching online for homes up to

$250,000 and above. And consider improvements that might help you sell.

Remodeling magazine’s 2011 – 2012 list of home-improvement cost-to-value

figures includes several projects that can add to curb appeal: a steel entry

door (73 percent of the cost might be recouped), a garage-door replacement (72

percent), a wood deck (70 percent), and vinyl siding (70 percent).

Reach out

Plan for hobbies or a

second career to ease the transition into retirement. Our survey found that

letting go of a familiar identity, say, as an employee of a company or member

of a profession, can take its toll. Survey respondents who reported a loss of

identity in retirement were only one-third as likely to be highly satisfied as

those who felt no such loss. That gap didn’t vary with income.

Nella G. Barkley, CEO

of Crystal Barkley, a life- and career-coaching company in Charleston, S.C.,

offers this suggestion: First, list your “inventory of skills,” such as

troubleshooting or the ability to direct groups in decision-making. Ask others

to evaluate you, too, for fresh perspectives.

Nella G. Barkley, CEO of Crystal Barkley: First, list

your “inventory of skills,”

Match those skills

with pursuits – either paid or unpaid – you’d like to try. An accountant who

wants to play in a jazz band, for instance, might first offer book-keeping

services to one, which could lead to informal jamming and maybe performances.

Researching your interest will help you find people doing what you’d like to

do. “Then,” Barkley says, “you get sent to the other people who are active in

that world, and your knowledge grows.”

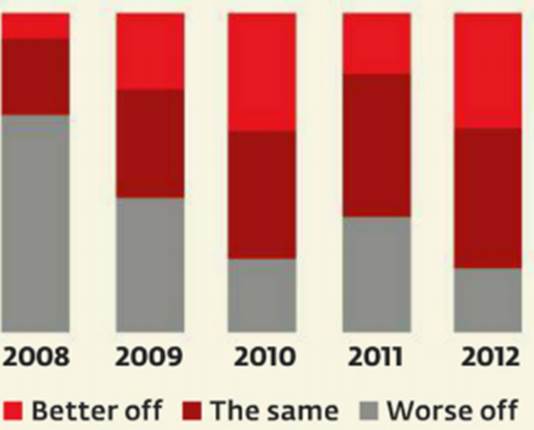

How are you doing? Better.

Thirty-six percent of

subscribers told us they were better off financially than they were a year ago,

and 20 percent reported being worse off. That’s a reversal from the results of

our 2011 survey. Here’s how our subscribers’ fortunes have fared since the 2008

financial crisis started.

Thirty-six percent of subscribers told

us they were better off financially than they were a year ago, and 20 percent

reported being worse off.